nh meals tax calculator

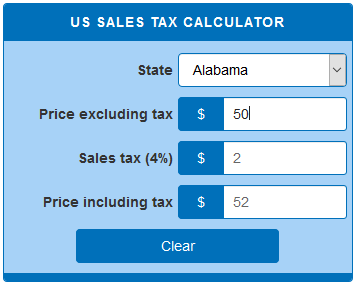

2022 New Hampshire state sales tax. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

For additional assistance please call the Department of Revenue Administration at 603.

. For the tax calculators below be sure to have your 1099 or W-2 form handy and be ready to answer a few basic questions about your filing status income deductions and credits. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. This tax is only paid on income from these sources that is 2400.

Nh Food Tax Calculator. Of such organization shall be subject to. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party.

Enter your info to see your take home pay. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Meals paid for with food stampscoupons.

Rev 70104 Department means the New Hampshire department of revenue administration. Usually the vendor collects the sales tax from the consumer as the consumer makes a. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for. Some schools and students. NH EASY Gateway to Services New Hampshires Electronic Application System.

Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forwardThe state meals and rooms. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. The state does tax income from interest and.

Please note that effective October 1 2021 the Meals Rentals Tax rate is. New Hampshire has a 0 statewide sales tax rate and does not allow local. Ss by 2504 eff 10-12.

Exact tax amount may vary for different items. Nh meals tax calculator. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes.

New Hampshire is one of the few states with no statewide sales tax.

New Hampshire Sales Tax Handbook 2022

Us Sales Tax Calculator Calculatorsworld Com

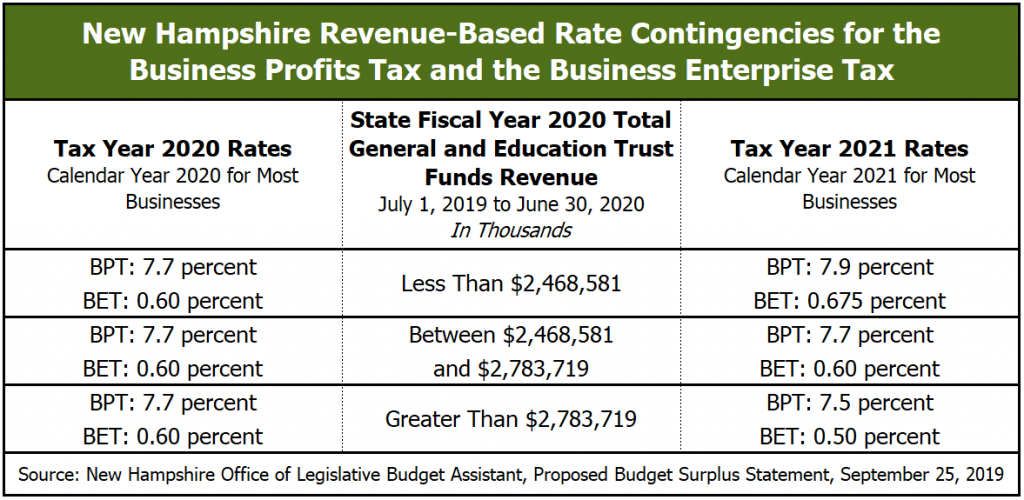

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

Should You Move To A State With No Income Tax Forbes Advisor

Sales Taxes In The United States Wikipedia

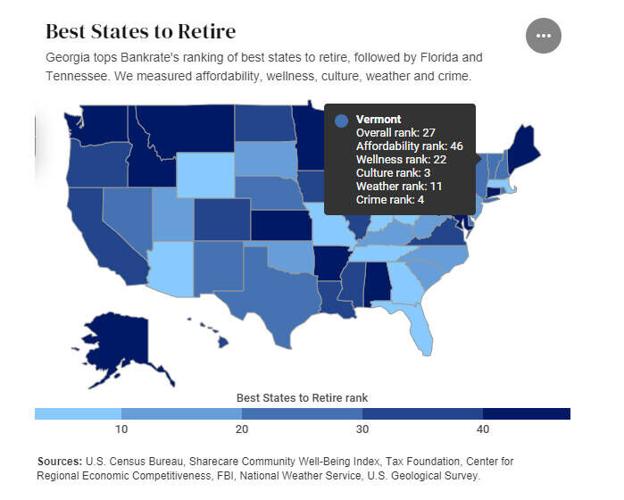

How We Rank Retirement In Vt N H Local News Caledonianrecord Com

Meals Rooms Rentals Tax Data Nh Department Of Revenue Administration

States With No Sales Tax What You Need To Know

New Hampshire Income Tax Calculator Smartasset

Business Nh Magazine Nh Dept Of Revenue Changing Data System

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

New Hampshire Veterans Benefits

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Sales Tax Rate 2022

Maine Sales Tax Calculator And Local Rates 2021 Wise